Foreign Trade Zone Warehouse

What is the FTZ Program?

The Foreign Trade Zone (FTZ) program is a partnership of the U.S. government and private companies. Each approved location is specially-designated and considered to be outside of U.S. Customs territory. When cargo arrives in the country for an FTZ operator, it does not clear Customs at the Port of Entry. The cargo receives preferential treatment with duties deferred, reduced or eliminated. In addition, there are supply chain, inventory control and other savings realized.

Capitol Warehousing Revolutionizes Logistics with First-of-its-Kind Facility

In an exciting development for logistics and warehousing in northern Illinois, Capitol Warehousing, in collaboration with the Greater Rockford Airport Authority (GRAA), has launched the region’s first facility offering Foreign Trade Zone (FTZ#176) services. This groundbreaking service, located at our state-of-the-art facility in Belvidere, Illinois, marks a significant milestone in our mission to provide comprehensive logistics solutions.

Why This Matters for Your Business

Unprecedented Access to FTZ Benefits: For the first time in the Rockford-Belvidere region, businesses of all sizes can now leverage FTZ benefits directly through our warehousing services. This means improved cash flow by deferring tariffs and reducing supply chain risks, without the need for companies to activate their own FTZ operations.

-

- A Hub of Trade and Investment: “We expect companies across Northern Illinois and Wisconsin to benefit from this service, further placing the Rockford-Belvidere region at the center of trade and investment activity,” says Josh Rodman, General Manager at Capitol Warehousing. Our facility is not just a warehouse; it’s a catalyst for regional economic growth.

- To understand the broader impact and the role of FTZ#176 in promoting trade and investment, please visit FTZ Rockford.

Partnering for Progress

The Greater Rockford Airport Authority (GRAA) plays a pivotal role as the grantee of the National FTZ Board that administers FTZ #176. Together, our collaboration is setting new standards in logistics and trade facilitation.

What are the Benefits of the FTZ Program?

Capitol Warehousing is a Foreign Trade Zone (FTZ) Warehouse. This means we can significantly reduce your inventory carrying costs.

By importing into our FTZ, we can defer your customs clearance process, deferring all of your import tariffs and fees for as long as we hold your inventory.

Instead of paying the full value of the import tariff upon import of the container at the U.S. port of entry, you will instead only pay the import tariff for the product as you pull each item individually from our warehouse, controlling smaller cash payments as product is used rather than paying a single upfront import tariff for the entire container value

The deferral is especially impactful for companies impacted by Section 301 Tariffs on imports from China, and Section 232 Tariffs on Steel & Aluminum, as these products are subject to especially high carrying costs due to high tariff rates.

More simplified:

- Defer your import tariffs and fees

- Reduce inventory carrying costs

- Pay import tariffs in smaller amounts later, rather than full upfront cost at port of entry

Will My Company Benefit?

Indicators that your company should consider FTZ include:

- You import significant value of product, and/or expect imports to grow

- You re-export a substantial percentage of imports

- You hold significant value of imported inventory

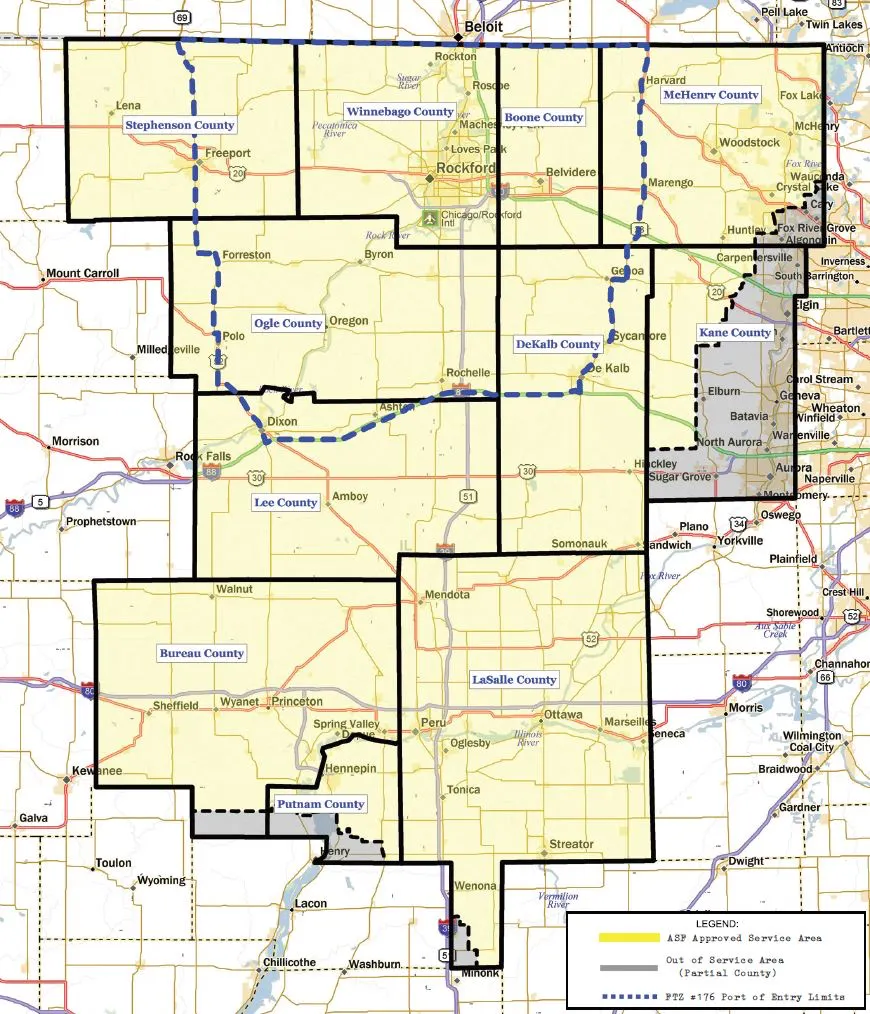

FTZ #176 Approved Service Area